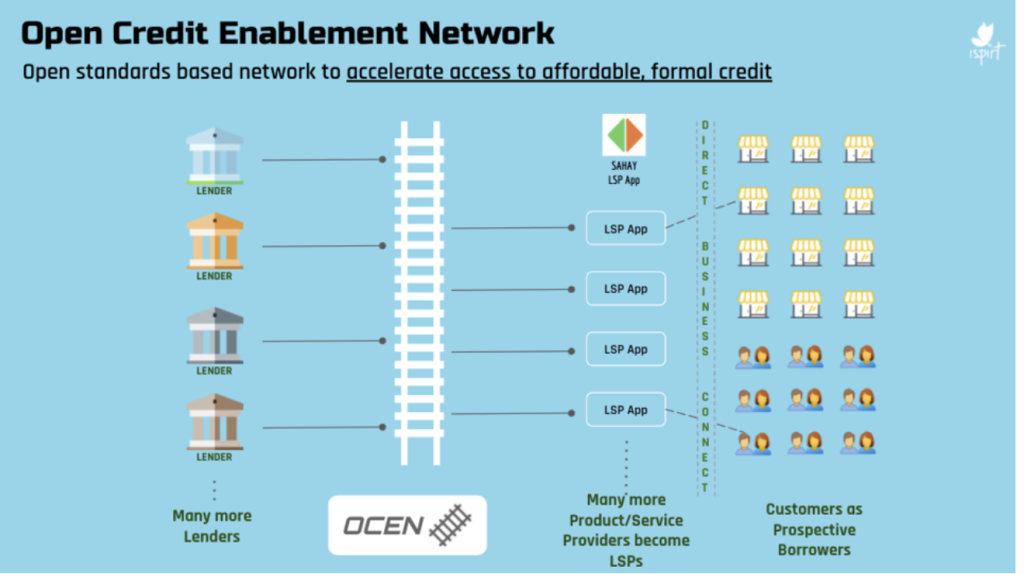

India’s Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the country’s economy, contributing to its inventiveness and tenacity. These businesses are the foundation of the economy, fostering growth, innovation, and job creation. Nevertheless, in spite of their crucial function, MSMEs sometimes struggle to get timely and reasonably priced finance. The Open Credit Enablement Network (Ocen), a ground-breaking project that promises to transform India’s financial landscape, has emerged as a ray of hope in answer to this urgent need

MSMEs in India face many challenges along the way, especially when trying to obtain loans. Conventional banking channels frequently pose considerable obstacles, with lengthy approval processes, onerous documentation requirements, and exorbitant interest rates.

Amid these difficulties, Ocen shows up as a revolutionary force, redefining how credit is obtained and handled in India by utilizing technology. With a foundation in innovation and a fervor for inclusivity, Ocen seeks to democratize MSMEs' access to financing, enabling them to reach their maximum potential and propel economic growth.

Ocen's advanced three-layered architecture was carefully created to provide smooth and effective financial services. Together, the identity layer, payment layer, and data layer enable quick verification, safe data exchange, and seamless money transfers. Ocen gives lenders the ability to make well-informed financing decisions by utilizing cutting-edge technology like machine learning and biometric authentication. This opens up new avenues of opportunity for MSMEs.

The Art of Risk: What Top 100 Investors Teach Us About Uncertainty

Risk is a constant in investing and business. While many fear it, the most successful investors know how

Reliance Jio’s AI Cloud Welcome Offer: A Smart Move or a Risky Gamble?

Understanding the Costs of Selling Your Business: A Complete Guide

Selling a business is more than a financial transaction—it’s a pivotal moment that can redefine your career and

Bridging the Gap: Innovative Strategies for Business Acquisition Negotiations

When acquiring a business, three key figures often come into play: the seller’s asking price, the buyer’s offer,

Pingback: AI: The Brain Drain Debate - Will It Diminish Our Intellectual Edge?Will AI Make Us Dumber..? - MergeDeck